Receiving a letter from the Franchise Tax Board (FTB) can be concerning, but it’s important to understand that these letters are often routine and don’t always indicate a major problem. This article provides a comprehensive guide to the various reasons you might receive an FTB letter and what steps you should take.

1. Introduction: Understanding the Franchise Tax Board (FTB)

- Who is the FTB and What Do They Do?

The California Franchise Tax Board (FTB) is a state government agency responsible for administering California’s personal income tax and corporate taxes. They ensure that individuals and businesses comply with tax laws and contribute their fair share to fund public services.

- Common Reasons for FTB Contact:

The FTB communicates with taxpayers for various reasons, including: * Filing reminders * Requests for information * Notices of tax due * Audit notifications * Refund updates

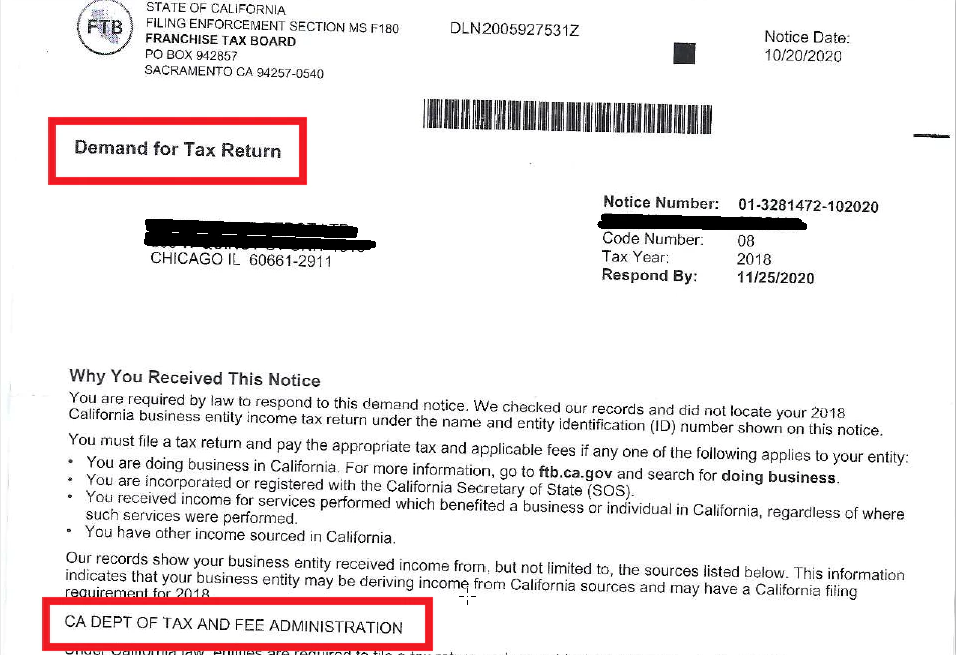

2. Tax-Related Notices

- Income Tax Returns: Filing, Payments, and Audits:

The most common reason for receiving an FTB letter is related to your income tax return. This could be a reminder to file your return, a notice about a missing payment, or a notification of a discrepancy in your filing.

- Business Taxes: LLC Fees, Sales Tax, and More:

If you own a business in California, you might receive letters regarding various business taxes, such as LLC annual fees, sales tax, or payroll taxes.

- Potential Issues: Underpayment, Late Filing, Errors:

FTB letters might indicate issues like underpayment of taxes, late filing penalties, or errors in your tax return that need correction.

3. Information Requests and Verification

- Requests for Documentation: Income Verification, Expense Support:

The FTB might request supporting documentation for information provided on your tax return. This could include W-2s, 1099s, receipts for deductions, or other proof of income and expenses.

- Clarification of Information: Discrepancies, Updates to Your Records:

You might receive a letter asking you to clarify discrepancies or provide updated information, such as a change of address or changes in your dependents.

- Identity Verification: Confirming Your Information:

The FTB may occasionally request information to verify your identity and prevent fraud.

4. Notices of Assessment and Collection

- Understanding Tax Assessments: What They Mean and Why You Receive Them:

A tax assessment is a notice indicating that you owe additional taxes, penalties, or interest. This could be due to an error in your return, an audit adjustment, or a failure to pay on time.

- Collection Procedures: Notices, Payment Options, and Potential Consequences:

If you have an outstanding tax liability, the FTB will send notices and offer various payment options. Failure to respond or pay can lead to collection actions, such as wage garnishment or liens.

5. Audits and Investigations

- Types of Audits: Correspondence, Office, and Field Audits:

The FTB conducts different types of audits, including correspondence audits (conducted by mail), office audits (requiring you to visit an FTB office), and field audits (conducted at your business location).

- What to Expect During an Audit: Process, Documentation, and Representation:

An audit involves a review of your financial records to ensure accuracy and compliance. You’ll need to provide documentation and may choose to have a tax professional represent you.

6. Appeals and Resolutions

- Disagreeing with an FTB Decision: Filing an Appeal:

If you disagree with an FTB assessment or audit finding, you have the right to appeal the decision. The FTB provides a formal appeals process with specific deadlines.

- Negotiating a Payment Plan or Offer in Compromise:

If you’re unable to pay your tax liability in full, you may be able to negotiate a payment plan or an offer in compromise (OIC) to settle your debt for a lower amount.

7. Other Reasons for Contact

- State Tax Refunds: Notifications and Processing:

The FTB will send you a notice if you’re due a state tax refund, including information about the refund amount and processing time.

- General Inquiries and Correspondence:

You might receive letters regarding general inquiries, updates to tax laws, or other relevant information.

8. Important Steps to Take

- Don’t Ignore FTB Correspondence:

It’s crucial to open and respond to all FTB letters promptly. Ignoring them can lead to penalties, collection actions, and further complications.

- Gather Relevant Documents:

If the letter requests information or documentation, gather all relevant materials before contacting the FTB.

- Seek Professional Help When Needed:

If you’re facing a complex tax issue, an audit, or need assistance with an appeal, consult with a qualified tax professional.

9. Preventing Future Notices

- Accurate Record-Keeping:

Maintain organized and accurate records of your income, expenses, and tax payments to avoid discrepancies and potential audits.

- Timely Filing and Payments:

File your tax returns and make payments on time to avoid late filing penalties and interest charges.

- Understanding Tax Laws:

Stay informed about California tax laws and any changes that may affect your obligations.

10. Conclusion: Navigating FTB Communications

While receiving a letter from the FTB can be unsettling, understanding the reasons behind the communication and taking appropriate action can help you resolve any issues efficiently. By staying organized, informed, and proactive, you can maintain good standing with the FTB and avoid unnecessary stress.

FAQs

1. What should I do if I receive a letter I don’t understand?

Contact the FTB directly using the phone number or contact information provided in the letter. They can clarify the purpose of the letter and answer your questions.

2. What if I can’t afford to pay the amount due?

Contact the Franchise Tax Board to discuss payment options, such as installment agreements or offers in compromise.

3. How long do I have to respond to an FTB letter?

The letter will usually specify a deadline for response. It’s important to adhere to this deadline to avoid further penalties or actions.

4. Can I appeal an FTB decision?

Yes, you have the right to appeal most FTB decisions. The letter will typically provide instructions on how to file an appeal.

5. What should I do if I disagree with an audit finding?

You can appeal the audit findings through the FTB’s appeals process.

6. How can I find a qualified tax professional to help me?

You can search for certified public accountants (CPAs) or enrolled agents (EAs) specializing in California tax law.

7. Where can I find more information about California taxes?

The FTB website (www.ftb.ca.gov) is a valuable resource for tax information, forms, and FAQs.

8. What are some common mistakes that trigger FTB letters?

Common mistakes include: * Math errors * Missing information * Claiming ineligible deductions * Failing to report all income

Checklist for Responding to an FTB Letter:

- [ ] Read the letter carefully and identify the reason for contact.

- [ ] Gather all relevant documents and information.

- [ ] Contact the FTB if you have questions or need clarification.

- [ ] Respond to the letter by the specified deadline.

- [ ] Consider seeking professional help if needed.